IG Motor Group - Where Quality and Reliability Meet.

Be on the road in just 48 hours!

0% Deposit

Large Section of Cars

Nationwide Warranties

Unparalleled Expertise

Get A PERSONALISED CAR FINANCE QUOTE TODAY!

0% Deposit

All Credit Backgrounds Considered

Flexible Payment Terms

Large Selection of Cars

Nationwide Warranties

We pride ourselves in our extensive range of brand new and second hand used cars throughout the UK.

About Us

Welcome to IG Motor Group, your trusted source for quality used vehicles in Manchester. With over 15 years of experience in the motor industry, we have established ourselves as a leading dealership near the city center. As a family-run business, we take great pride in delivering exceptional service and providing our customers with reliable, high-quality used and new cars.

We also work closely with manufacturers, large motor groups and key finance partners to offer some of the most competitive leasing rates in the market, ensuring our customers come back to us time and time again.

Who can get a car on Personal Contract Purchase or Hire Purchase?

One of the great things about HP or PCP is that most individuals who meet the basic age, residency, and financial stability criteria can use HP or PCP to finance a car.

The choice between HP and PCP depends on factors like the desire for ownership, monthly budget preferences, driving habits, and flexibility needs.

Rest assured this is a quick and easy process.

Unparalleled Expertise

Dedication to Quality

Customer Centric

Reliability Matters to Us

Need finance and a car?

Browse a selection of our high quality vehicles!

Drive away in just 48 hours!

Find a method suitable for your needs...

Why PCP?

Lower Monthly Payments

PCP usually offers lower monthly payments because you are not paying off the entire vehicle but only the depreciation and interest

Access to newer cars

PCP deals often make it easier to drive newer more expensive cars

Mileage and condition

These agreements usually come with mileage limits and condition requirements, ultimately these help maintain the cars residual value

Flexibility at the end of the term:

At the end of the term you have 3 options:

Return the car

Pay final balloon payment to own the car

trade the car in for a new one

Why HP?

Ownership at the end

With HP, you own the car outright after the final payment. There are no large final payments (balloon payments) to worry about.

Simpler Agreements

HP agreements are generally more straightforward. You're essentially spreading the cost of the car over a set period with interest.

No Mileage Restrictions

HP agreements typically don't have mileage restrictions, making them suitable for high-mileage drivers.

No Condition Penalties:

Since you own the car once the contract is over, you're not subject to penalties for damage or excessive wear and tear (beyond the vehicle’s usual depreciation).

Choose from a wide range of car brands

Don't just take our word for it...

Frequently Asked Questions

What is Hire Purchase (HP)?

Hire Purchase (HP) is a type of car finance agreement that allows you to spread the cost of a vehicle over a set period, typically ranging from 12 to 60 months.

How Hire Purchase works

Deposit: You begin by paying an initial deposit, usually around 10% of the car’s price, although this can vary.

Monthly Payments: The remaining balance is then paid off in fixed monthly installments over the agreed term. These payments include both the capital repayment and the interest.

Ownership: Unlike a Personal Contract Purchase (PCP), you are effectively hiring the car until the final payment is made. Once all the payments have been completed, ownership of the car is transferred to you.

Key Features of Hire Purchase

Interest Rates: The interest rate on HP agreements can vary, but it's typically fixed, meaning your monthly payments stay the same throughout the term.

Deposit Requirements: While a deposit is usually required, some dealers might offer zero deposit HP deals.

Credit Check: As with other finance options, HP agreements involve a credit check. Your credit score will affect the interest rate and terms you’re offered. No Mileage Restrictions: Unlike PCP, there are no mileage limits with HP agreements. This makes HP suitable for those who drive a lot of miles.

No Final Balloon Payment: Unlike PCP, there’s no large final payment required to own the car at the end of the term. Once you've made all the monthly payments, the car is yours.

Ideal Scenarios of choosing Hire Purchase?

Long-Term Ownership: If you plan to keep the car for a long time, HP is a good option since you’ll own the car outright at the end of the term.

High Mileage: If you drive a lot, HP is suitable as there are no mileage restrictions.

Straightforward Finance: For those who prefer a simple, clear repayment structure without a large final payment.

What is Personal Contract Purchase (PCP)?

Personal Contract Purchase (PCP) is a popular type of car finance that offers flexibility and lower monthly payments compared to other financing methods like Hire Purchase (HP).

How Personal Contract Purchase (PCP) Works

Deposit: You begin with an initial deposit, typically around 10% of the car's value, though this can vary.

Monthly Payments: You make fixed monthly payments over an agreed period, usually between 24 to 48 months. These payments cover the depreciation of the car during the term, not its full value.

Guaranteed Minimum Future Value (GMFV): At the start of the agreement, the finance company sets a GMFV, which is the car’s estimated value at the end of the contract. This figure is crucial as it determines your final balloon payment.

End-of-Contract Options: At the end of the PCP term, you have three options: Return the Car, Make a Balloon Payment or Trade-In.

Key Features of PCP

Lower Monthly Payments: Since you’re only paying off the car’s depreciation and not the full value, monthly payments are generally lower than with HP.

Mileage Limits: PCP agreements include mileage restrictions. Exceeding the agreed mileage can result in additional charges.

Condition Requirements: The car must be kept in good condition to avoid extra fees at the end of the term.

Interest Rates: Interest rates can be fixed or variable, and your credit score will influence the terms offered.

Ideal Scenarios for Choosing PCP

Regularly Updating Cars: If you like driving new cars and changing them frequently, PCP is an excellent option due to the flexibility at the end of the term.

Lower Monthly Budget: If lower monthly payments are a priority, PCP is typically more affordable on a month-to-month basis than HP.

Flexibility: If you want the option to return, keep, or trade in the car, PCP offers multiple end-of-term options to suit changing circumstances.

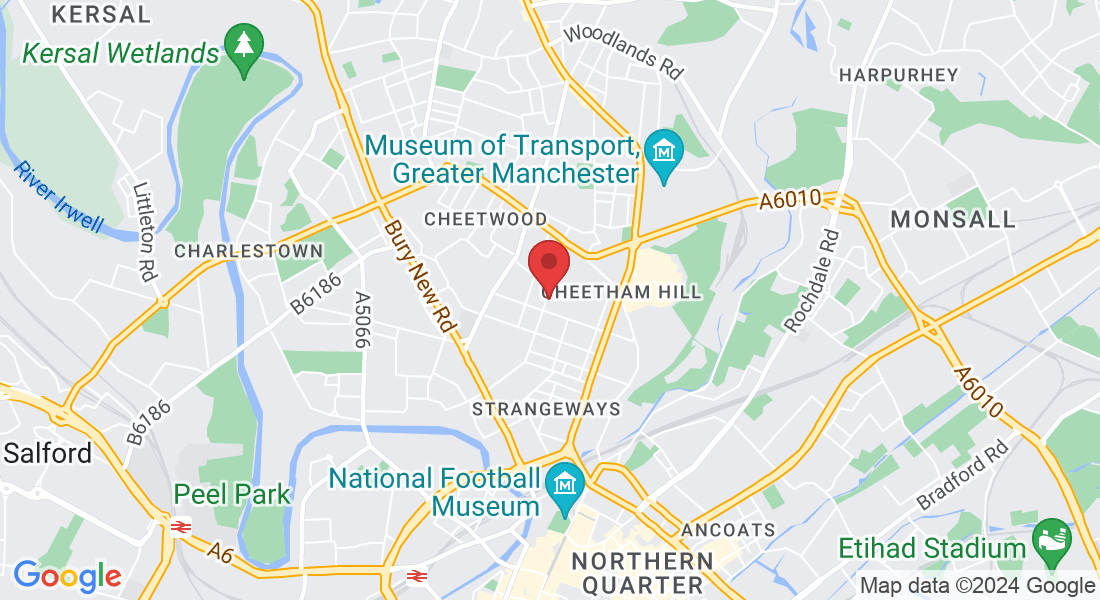

IG Motor Group is the trading name of Autosolutions Runcorn Ltd, Autosolutions Runcorn Ltd is authorised and regulated by the Financial Conduct Authority with firm reference number FRN 1005884.

We are a credit broker and not a lender. Our registered trading address is 72, Sherborne Street, Cheetham Hill, Manchester M8 8HU. We can introduce you to a panel of lenders we work with and who we believe have the requisite appetite for your borrowing needs. We can only introduce you to the lenders we work with and each lender/finance provider may have different interest rates and charges. We may receive a commission from the lender for introducing you to them. The commission received is either a fixed fee or a percentage of the amount you borrow. The lenders we work with could pay commissions at different rates, however, the amount of commission that we receive from a lender does not influence the amount that you pay to that lender under your loan agreement.

In the case of any complaints please email [email protected] for a copy of our Complaints policy.

The Financial Ombudsman Service (FOS) is an agency for arbitrating unresolved complaints between regulated firms and their clients. Full details of the FOS can be found on its website at www.financial-ombudman.org.uk

Data Protection License ICO: ZA781871

Runcorn Ltd

72 Sherborne Street, MANCHESTER, LANCASHIRE, M8 8HU Registered in England & Wales

Company No. 12358102

FCA Number: FRN 1005884